Financial markets have their cycles, typically ranging from years to decades. Arguably the world’s most popular emerging market, the crypto market features much shorter cycles, usually in a matter of months. Starting the end of 2008 and absolutely zero, Bitcoin went through much rise and fall, was attacked and declared dead hundreds of times, yet rose from ashes every single time and reached tens of thousands US dollars at its peak in 2017. The blockchain as an epoch-making technology revolution brings about this exponential growth in crypto markets. The unprecedented growth and born greed rooted deeply in humanity induced fickle speculation, which effectively imposes a leverage on the entire market and magnifies all price movements. This is largely the reason all cryptos suffer from supreme volatility.

Who benefit most from the crypto market growth? The early investors and long-term holders. Their persistence falls into two categories: active and passive. The active holders have strong faith on Bitcoin and the entire crypto market. They chose to invest a signifi- cant portion, if not all of their assets into the cryptos, and hold on for dear life (HODL) disregarding extreme volatility. Their rewards come with high prices, which requires strong will, persevered execution, great foresight or ridiculous blind luck — most certainly not the cup of tea for everybody. The most aggressive of them sold their houses and went all-in back in 2014. Investors with this level of insight and guts can be counted easily.

On the other hand, the passive holders never have much faith in the market. They have always been skeptical, and only invest with capital they can afford to lose. Most of them stay in a low profile and are quite reluctant to admit they ever invested until they feel comfortably sure, since their expectations on their crypto asset returns are not much better than none. Nevertheless, most of them have accessed ten-fold or hundred-fold profit. This is achievable by an average crowd, and it is never too late to invest — remember a pizza used to sell for 10,000 whopping Bitcoins?

Passive investing is an investment strategy that aims to maximize returns over the long run by keeping the amount of buying and selling to a minimum, traditionally referred to as ’buy and hold’. Typical passive investing is to hold a cap-weighted basket of underlying instruments in portfolio, such as the ETFs and index investing, commonly exercised by mutual funds. It features low or zero management fee, ultra-low turnover, and better returns over a majority of actively managed funds. In 2007, Warren Buffett bet a million dollars that an index fund would outperform a collection of hedge funds in the long run like 10 years. Over the course of the bet the S&P 500 index fund returned 7.1% compounded annually, significantly more than the basket of funds selected by his counter party, an asset manager at Proégé Partners. That active basket only returned an average of 2.2% annually.

What happens if we practise passive investing in the crypto domain? We constructed and studied in this paper typical crypto ETF constructions and performances. Section 2 introduces conventional cap weighted ETF and potential improvements, Section 3 discusses the equal weighted construction, where small cap premium plays an important role, as well as the performance with more breath when we generalize top 20 to top 50 cap underlyings. Conclusions follow in Section 4.

2Crypto ETFs

Though decentralized and distributed technologies are widely deployed, all cryptocurrencies are effectively managed and maintained by centralized organizations or companies, and the token value is but a representation of the network value. As Metcalfe’s law states, the value of a telecommunications network is proportional to the square of the number of connected users of the system (n^2). The more useful and widely applicable the network, the more valuable the ecosystem and hence the token. This is the de-facto fundamental support to all token prices.

2.1 The top 20 cap weighted ETF

Note most cryptos other than bitcoin carried poor liquidity before 2013, some only available over the OTC market. We construct a cap weighted ETF on top 20 cryptos from mid 2013 with monthly turnover, which we call ’ETF20 cap naive’. The universe was ranked and picked point-in-time. Since bitcoin took over 80% dominance before 2017, the performance would be almost identical to bitcoin, as is demontrated in Fig.1. The left shows the ETF and bitcoin performances, where we normalized the initial positions and set the y-axis on a logarithm scale for ease of comparison. The plot on the right is the cumulative P&L difference between the two (ETF20 cap naive less bitcoin). The information ratio (IR) for bitcoin is 1.5, return 130%, volatility 86%, max drawdown 82%, all numbers annualized except drawdown (annualization applies to all numbers in this paper unless otherwise noted). The naive ETF gives IR 1.6, return

2.2 Improvements

The naive cap weighted strategy offers limited insight on passive crypto investing. It is quite similar to holding Bitcoin alone, and a small mix of low-cap cryptos seems to pull performance slightly down before 2017, until Ethereum joined the gang in 2017 and brought more volatility to the game. Most other cryptos carry negligible weights throughout the period.

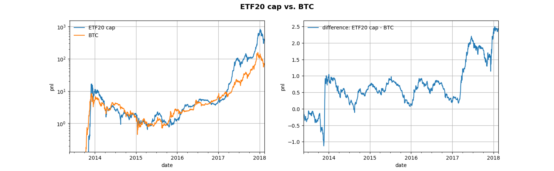

A natural next step is to enforce 10% threshold on any cryptos, i.e. if the underlying crypto passes 10% in weight, we set it to 10% as long as it is possible. We call this strategy ’ETF20 cap’, whose performance is displayed in Fig. 2. ETF20 cap gives IR 1.7, return 180%, volatility 100%, max drawdown 90%, a good improvement over holding Bitcoin alone. From the right plot we confirmed that ETF20 cap outperforms Bitcoin, except see sawed between 2014 and 2017. The max relative rise occurred toward the end of 2013

the turbulance in Venezuela triggered a strong demand in Bitcoins, and an overwhelming number of ICOs without solid use cases added fuel to the flames. This was the first crypto bubble and triggered large-scale regulation particularly in China, followed by a long bear market for the next year and half. This is an extraordinary length considering crypto’s short market cycles — the longest bear market recorded in its brief history. Also note there were two major surges in 2017. The first was led by the rise of Ethereum — a revolutionary crypto featuring smart contract deployment, the very first of its kind. The second happened when Bitcoin regressed to its fair value alone and slowly after another surge during a new North Korea nuclear crisis, while the rest of cryptos caught up. No wonder the year 2017 was generally considered the genesis of the upcoming blockchain era — it is almost surely the first year cryptos drew massive public concern.

Fig. 2 gives the first indication of small cap premium in the crypo market. This is a popular and famous (if not the most) risk premium in quantitative finance domain — stocks with small caps enjoy better growth statistically, as with greater risk come greater return. The small cap premium is one the earliest factors discovered in the stock market, and applicable almost across the globe. We are not surprised to witness the same phenomenon in the crypto market — investing in riskier small cap cryptos offers better returns. This premium clearly goes beyond simple leveraging effect.

Figure 2. The performances of top 20 cap cryptos, cap weighted (ETF20 cap) and Bitcoin (BTC).

Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF20 cap less

BTC).

3Small cap premium on cryptos

What if we give higher weights to smaller caps? This could be the first smart beta discovered on cryptos.

3.1 Top 20 caps equal weighted

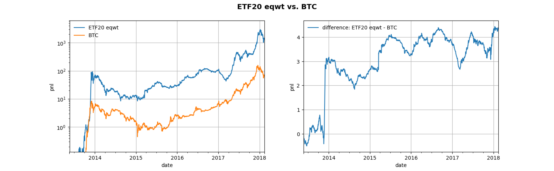

Let’s construct a simple strategy — an equally weighted portfolio on the same top 20 cap universe, which effectively increases the weights on cryptos of smaller sizes. We call it ’ETF20 eqwt’. The performance is shown in Fig. 3. The new strategy offers annual IR 1.8, return 220%, volatility 120%, max drawdown 90%, somewhat better than its predecessor. From the plot on the right we see a more consistent premium from small cap cryptos over bitcoin. We also observed annual cyclically in this premium. In a live-trading environment we must consider transaction costs, but the analysis above is based on monthly turnover over top cap cryptos, the same conclusion almost surely applies. However, over 100% annual volatility and 80% max drawdown are way beyond the psychological threshold of average investors. We strongly suggest all investors to exercise your highest level of caution, and think twice how much capital you are literally willing to HODL and lose before any serious investment decisions.

3.2 Generalizing to top 50 caps

We then generalized the equal weighted portfolio to top 50 cap cryptos (’ETF50 eqwt’) for more breadth, see Fig. 4. The new portfolio offers annual IR 2.7, return 310%, volatility 120%, max drawdown 82%, a significant improvement over ETF20 equal weighted. Smallcap premium is clearly stronger and more consistent in cryptos with lower caps. We include performance numbers for all three scenarios in Table. 1. Generalization as such is trivial and can be done on higer universes if needed, and the premium continues to grow as the cap reduces.

Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF20 cap less

BTC).

3Small cap premium on cryptos

What if we give higher weights to smaller caps? This could be the first smart beta discovered on cryptos.

3.1 Top 20 caps equal weighted

Let’s construct a simple strategy — an equally weighted portfolio on the same top 20 cap universe, which effectively increases the weights on cryptos of smaller sizes. We call it ’ETF20 eqwt’. The performance is shown in Fig. 3. The new strategy offers annual IR 1.8, return 220%, volatility 120%, max drawdown 90%, somewhat better than its predecessor. From the plot on the right we see a more consistent premium from small cap cryptos over bitcoin. We also observed annual cyclically in this premium. In a live-trading environment we must consider transaction costs, but the analysis above is based on monthly turnover over top cap cryptos, the same conclusion almost surely applies. However, over 100% annual volatility and 80% max drawdown are way beyond the psychological threshold of average investors. We strongly suggest all investors to exercise your highest level of caution, and think twice how much capital you are literally willing to HODL and lose before any serious investment decisions.

3.2 Generalizing to top 50 caps

We then generalized the equal weighted portfolio to top 50 cap cryptos (’ETF50 eqwt’) for more breadth, see Fig. 4. The new portfolio offers annual IR 2.7, return 310%, volatility 120%, max drawdown 82%, a significant improvement over ETF20 equal weighted. Smallcap premium is clearly stronger and more consistent in cryptos with lower caps. We include performance numbers for all three scenarios in Table. 1. Generalization as such is trivial and can be done on higer universes if needed, and the premium continues to grow as the cap reduces.

Figure 3. The performances of top 20 cap cryptos, equal weighted (ETF20 eqwt) and Bitcoin

(BTC). Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF20

eqwt less BTC).

(BTC). Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF20

eqwt less BTC).

Figure 4. The performances of top 50 cap cryptos, equal weighted (ETF50 eqwt) and Bitcoin

(BTC). Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF50

eqwt less BTC).

(BTC). Left: performances in logarithm scale. Right: their cumulative P&L difference (ETF50

eqwt less BTC).

Table 1. Performance summary for BTC, ETF20 cap (naive, improved, equal weighted) and ETF50 equal weighted.

4Conclusion

In summary, if we practiced passive investing consistently, assigned predefined weights and held on to a basket of cryptos with monthly turnover for a couple of years with expendable capital, we would benefit from small cap premium and earn higher and stabler returns than simply holding bitcoin. This is a typical phenomenon for most emerging markets, and the first and strong proof cryptos have qualified in the arena of security-like financial instruments. The more vibrant the new market, the stronger the small cap premium. Aslong as the fundamentals of the crypto market remain unchanged, excellent new projects and ecosystems backed by centralized organizations or companies will keep growing, and the premium will continue to persist.

4Conclusion

In summary, if we practiced passive investing consistently, assigned predefined weights and held on to a basket of cryptos with monthly turnover for a couple of years with expendable capital, we would benefit from small cap premium and earn higher and stabler returns than simply holding bitcoin. This is a typical phenomenon for most emerging markets, and the first and strong proof cryptos have qualified in the arena of security-like financial instruments. The more vibrant the new market, the stronger the small cap premium. Aslong as the fundamentals of the crypto market remain unchanged, excellent new projects and ecosystems backed by centralized organizations or companies will keep growing, and the premium will continue to persist.

★ WEBSITE ★ WHITEPAPER ★ ONE PAGER ★ PITCH DECK ★ ANN ★

★ TWITTER ★ FACEBOOK ★ LINKEDIN ★ INSTAGRAM ★ YOUTUBEANN ★ MEDIUM ★

★ TWITTER ★ FACEBOOK ★ LINKEDIN ★ INSTAGRAM ★ YOUTUBEANN ★ MEDIUM ★

Author : harum93

Tidak ada komentar:

Posting Komentar